- About

- For Business

- Alternative Dispute Resolution

- Banking Services and Secured Lending

- Commercial Contracts

- Commercial Dispute Resolution

- Commercial Property

- Construction Disputes

- Corporate Advice and Transactions

- Debt Recovery

- Employment Law

- Intellectual Property and IT

- Professional Negligence

- Professional Practices

- Property Litigation

- For Individuals

- For Public Sector

- Guides

- News

- Contact

Probate & Estate Administration

Dealing with the estate of a deceased individual can of course be a very upsetting and stressful time.

Our experienced team of probate lawyers offer invaluable advice and support during these difficult times, and aim to do so in the most efficient and cost – effective way possible.

We offer a flexible approach to our services, and can provide you with as much or as little support as you require. We can deal with the entire process, or we can deal with certain aspects only.

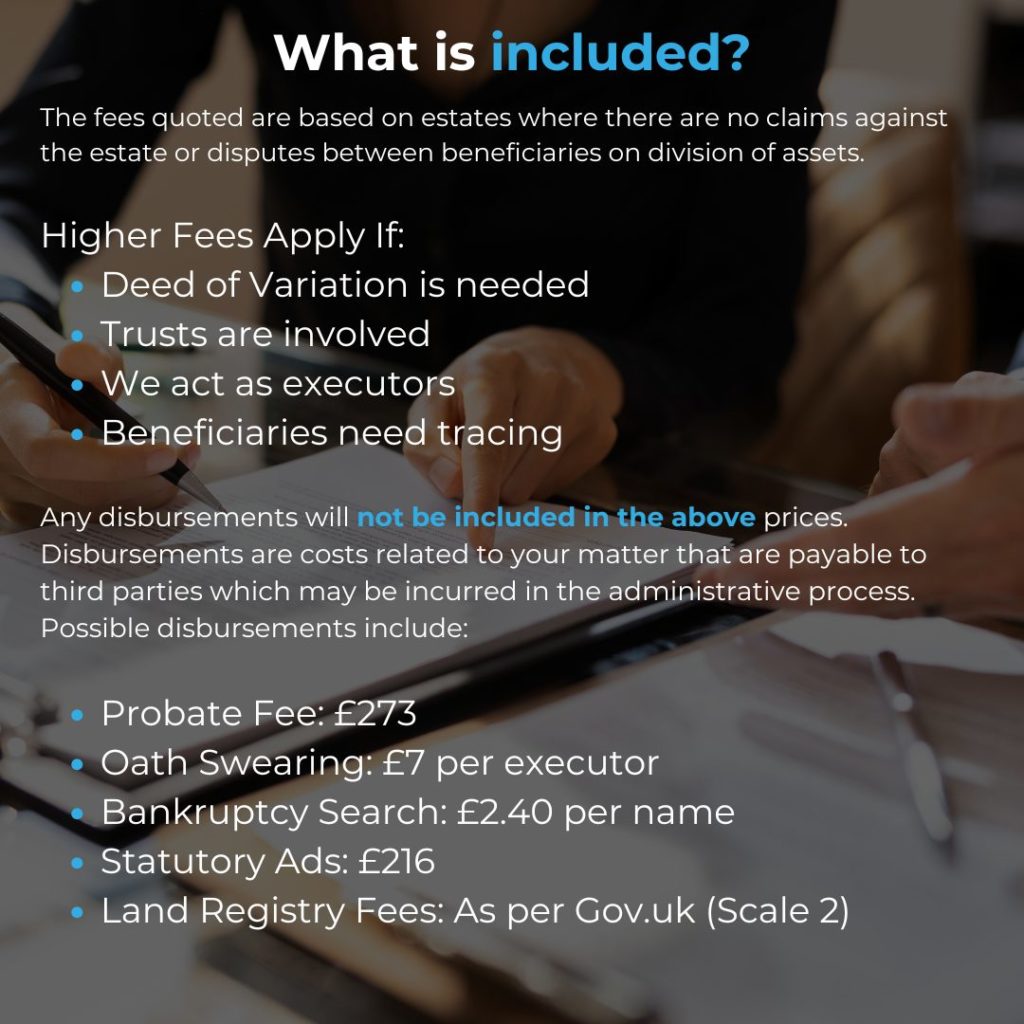

What will it cost?

What are the costs involved in instructing us to act in the administration of an estate where a Grant of Representation (Grant of Probate/Grant of Letters of Administration) is required?

Where we have been instructed in the administration of an estate of someone who has died and a Grant of Representation is required, our services involve the following:

- collate information and advise on inheritance tax implications (if any)

- prepare the necessary tax return (this is required even if there is no tax to pay)

- advise or arrange the payment of inheritance tax (if any)

- prepare the documents necessary for an application to the Probate Registry and submit the application

- encashing and/or transferring the assets

- preparing and submitting any necessary tax return for the administration period

- preparing the final estate accounts

- arranging distribution

Fees –

Our minimum costs for acting in the administration of an estate are £1,500 plus VAT.

Our average costs for acting in the administration of an estate are £3,000 plus VAT.

Our average costs, which depend on the value of the estate, are typically as follows:

| Value of the estate | Our Fees |

| £0 – £150,000 | £1,500 plus VAT |

| £150,001 – £400,000 | £1,500 plus VAT – £3,500 plus VAT |

| £400,001 – £750,000 | £3,500 plus VAT – £6,500 plus VAT |

| £750,001 – £1,500,000 | £6,500 plus VAT – £11,000 plus VAT |

Whilst the above are averages we will always aim to give you a fixed quotation once we have full details of the estate assets and liabilities.

If we are instructed to obtain a Grant of Representation only, without a full tax return or collating estate information or acting in the distribution of the estate, our fee will be £750 plus VAT.

How long will it take?

The timescales involved may vary from estate to estate. The value of the estate, number and type of assets and the number and extent of estate liabilities will increase the timescale.

On average, the estates which fall into the first range are dealt with within 10 weeks.

Those estates which fall within the other three ranges take longer, and the average timescale is 4-5 months.

Department: Private Client

Contact Us

Error: Contact form not found.

Testimonials and Reviews

Thank you for your exceptional conveyancing service. Your professionalism, clear communication, and attention to detail make the process seamless. I truly appreciate your support and wouldn’t hesitate to recommend you.

The exceptional Chris Beames has huge experience, is empathetic and able to explain things in a way that is clear and intelligible.

Georgia is extremely good at keeping me informed and her explanations are thoughtful balanced and clear.

Always use Berry Smith for all Legal work, have done for over 15 years & will continue to do so. Never had a bad experience with them.

Whilst the contact was totally professional, I enjoyed the friendly, “down-to-earth” approach, we could talk on a human-to-human level without the technical speak that you sometimes meet with legal representatives. I also considered that there was a business like, practical attitude

What our clients say

Able to explain things

The exceptional Chris Beames has huge experience, is empathetic and able to explain things in a way that is clear and intelligible.

A B –

Very approachable

Christina is very approachable and responds very quickly to my queries. In the end, I got what I wanted

Gek L –

Couldn’t have done it without you

We are now happily settling into our new home and obviously couldn’t have done it without you, so thanks so much for all your work and help!

Keiran M –

Brilliant experience

Brilliant experience, Georgia and Sharon have been so helpful throughout, responsive to questions and kept me updated. The purchase wasn’t as straightforward as we thought but I was provided with all the advice I needed. Thank you very much!

Sophia L –

They are truly professional

Chris and Sharon have the patience to explain and communicate clearly with any questions. They will pick my calls or return my calls at any point in time and answer my questions. They are truly professionals and I will always use Berry smith LLP.

Alexander D R –

Whole process seemed seamless

Christina was a pleasure to work with – very efficient and the whole process seemed seamless and more importantly painless. I have no hesitation in recommending Christina and Berry Smith for conveyancing work.

Ravi N –

Outstanding from start to finish

Gemma was outstanding from start to finish. No question was too silly and every response was prompt. The estate agent we used even commented to us their happiness with how quickly they got responses from Gemma during this process. She did an excellent job of making it as painless as possible

Dai L –

Would definitely recommend

Christina was brilliant, very friendly and professional and moved very quickly for us. Would definitely recommend to friends and family. Thank you Christina for all of your help.

Bianca W –

Thoughtful balanced and clear

Georgia is extremely good at keeping me informed and her explanations are thoughtful balanced and clear.

Kate M-B –